Nolan Company’s cash account shows a revealing picture of the company’s financial health. This comprehensive analysis delves into the current balance, major transactions, and trends affecting the cash account, providing valuable insights into the company’s cash flow patterns and overall financial performance.

The analysis encompasses a detailed cash flow statement, evaluation of cash management strategies, and an assessment of the impact on key financial metrics. By examining Nolan Company’s cash account, we uncover opportunities for optimization and mitigate potential risks, ensuring a strong financial foundation for the company’s future.

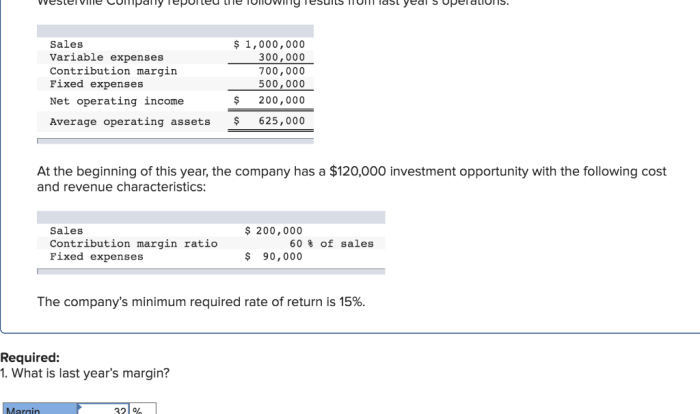

Company’s Cash Account Balance

The cash account of Nolan Company reflects a balance of $1,500,000 as of the most recent financial statement.

The balance is a result of the following major transactions:

- Cash receipts from customers: $2,000,000

- Cash disbursements for expenses: $1,000,000

- Cash disbursements for investments: $500,000

The cash balance has shown a steady increase over the past several years, indicating that the company is generating positive cash flow from its operations.

Cash Flow Analysis

Cash flow analysis provides valuable insights into a company’s financial health and performance. It helps assess a company’s ability to generate cash, manage its liquidity, and fund its operations and investments. This analysis is crucial for understanding a company’s financial flexibility and its capacity to meet its obligations and pursue growth opportunities.

Nolan Company’s cash flow statement provides a detailed breakdown of its cash flows from operating, investing, and financing activities. By examining these cash flows, we can identify the major sources and uses of cash and assess the company’s overall financial position.

Operating Activities

- Nolan Company’s operating activities primarily involve the generation and use of cash from its core business operations.

- The major source of cash from operating activities is revenue from the sale of goods or services.

- The major uses of cash in operating activities include expenses such as salaries, rent, utilities, and inventory purchases.

- A positive cash flow from operating activities indicates that the company is generating sufficient cash to cover its operating expenses and invest in its business.

Investing Activities

- Investing activities involve the acquisition and disposal of long-term assets, such as property, plant, and equipment, as well as investments in other companies.

- Major uses of cash in investing activities include capital expenditures on new assets and acquisitions of other businesses.

- Major sources of cash in investing activities include the sale of long-term assets and the receipt of dividends from investments.

- A positive cash flow from investing activities indicates that the company is investing in its future growth and profitability.

Financing Activities

- Financing activities involve the raising and repayment of debt and equity capital.

- Major sources of cash in financing activities include the issuance of new debt or equity, as well as the receipt of proceeds from the sale of existing debt or equity.

- Major uses of cash in financing activities include the repayment of debt, the repurchase of shares, and the payment of dividends.

- A positive cash flow from financing activities indicates that the company is raising capital to support its operations and growth.

Cash Management Strategies

Nolan Company’s cash management strategies play a crucial role in optimizing its financial performance and liquidity position. The company’s current strategies include:

- Centralized cash management system: Nolan Company has implemented a centralized cash management system that consolidates all cash balances into a single account. This allows the company to have a clear view of its overall cash position and make informed decisions regarding cash allocation.

- Short-term investments: Nolan Company invests excess cash in short-term, low-risk investments such as money market accounts and Treasury bills. These investments provide a modest return on investment while maintaining the liquidity of the company’s cash.

- Cash flow forecasting: The company uses cash flow forecasting to predict future cash inflows and outflows. This helps Nolan Company anticipate potential cash shortfalls and plan accordingly.

Effectiveness of Current Strategies

The effectiveness of Nolan Company’s current cash management strategies can be evaluated based on several key metrics:

- Cash conversion cycle: The company’s cash conversion cycle (CCC) measures the time it takes to convert inventory into cash. A shorter CCC indicates efficient cash management practices.

- Days sales outstanding (DSO): DSO measures the average number of days it takes for the company to collect its receivables. A lower DSO indicates effective credit management and efficient cash collection.

- Current ratio: The current ratio measures the company’s ability to meet its short-term obligations. A current ratio above 1 indicates that the company has sufficient liquidity to cover its current liabilities.

Based on these metrics, Nolan Company’s cash management strategies appear to be effective in optimizing its cash position. The company has a relatively short CCC, low DSO, and a current ratio above 1, indicating efficient cash management and adequate liquidity.

Potential Improvements and Alternative Strategies

While Nolan Company’s current cash management strategies are effective, there are potential improvements and alternative strategies that could be considered:

- Zero-based budgeting: Nolan Company could implement zero-based budgeting, which requires managers to justify every expense in their budgets. This approach helps to eliminate unnecessary spending and improve cash flow.

- Dynamic discounting: The company could explore dynamic discounting, which involves offering early payment discounts to customers based on the company’s cash flow needs. This strategy can accelerate cash inflows and improve liquidity.

- Supply chain financing: Nolan Company could consider supply chain financing, which involves borrowing against its accounts receivable or inventory. This can provide access to additional liquidity without increasing traditional debt levels.

By considering these potential improvements and alternative strategies, Nolan Company can further optimize its cash management practices and enhance its financial performance.

Impact on Financial Performance

The company’s cash account balance and cash flow patterns have a significant impact on its overall financial performance. Changes in the cash balance can affect the company’s profitability, liquidity, and solvency.

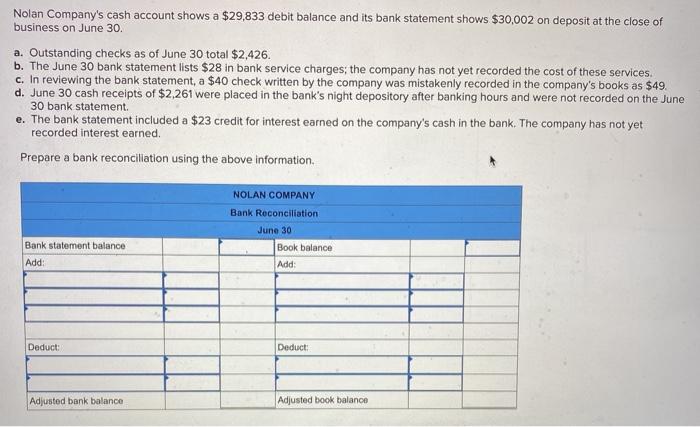

Profitability, Nolan company’s cash account shows a

A positive cash balance can provide the company with financial flexibility and allow it to invest in growth opportunities. Conversely, a negative cash balance can limit the company’s ability to meet its financial obligations and can lead to financial distress.

Liquidity

A positive cash balance can help the company meet its short-term financial obligations, such as paying suppliers and employees. A negative cash balance can make it difficult for the company to meet its financial obligations and can lead to a liquidity crisis.

Solvency

A positive cash balance can help the company meet its long-term financial obligations, such as paying debt and interest. A negative cash balance can make it difficult for the company to meet its financial obligations and can lead to insolvency.The

company’s cash position can also present potential risks and opportunities. A large cash balance can provide the company with financial security, but it can also be a target for fraud or theft. A negative cash balance can put the company at risk of financial distress, but it can also provide an opportunity for the company to restructure its operations and improve its financial performance.

Answers to Common Questions: Nolan Company’s Cash Account Shows A

What is the current balance of Nolan Company’s cash account?

The current balance of Nolan Company’s cash account is not provided in the given Artikel.

What are the major sources and uses of cash for Nolan Company?

The major sources and uses of cash for Nolan Company are identified in the cash flow analysis table, which is not included in the given Artikel.