Westerville company reported the following results from last year’s operations – Westerville Company has released its financial results for the previous year, showcasing remarkable achievements that have positioned the company for continued growth and success. This report delves into the company’s revenue and sales performance, expenses and cost structure, profitability and margins, balance sheet and financial position, cash flow and liquidity, key performance indicators (KPIs), and financial projections and forecasts, providing a comprehensive analysis of the company’s financial health and operational efficiency.

The company’s financial performance is a testament to its strategic planning, operational excellence, and commitment to delivering value to its stakeholders. This report provides valuable insights into the factors that have contributed to Westerville Company’s success and highlights areas for potential improvement, enabling investors, analysts, and other stakeholders to make informed decisions.

Financial Performance Analysis of Westerville Company

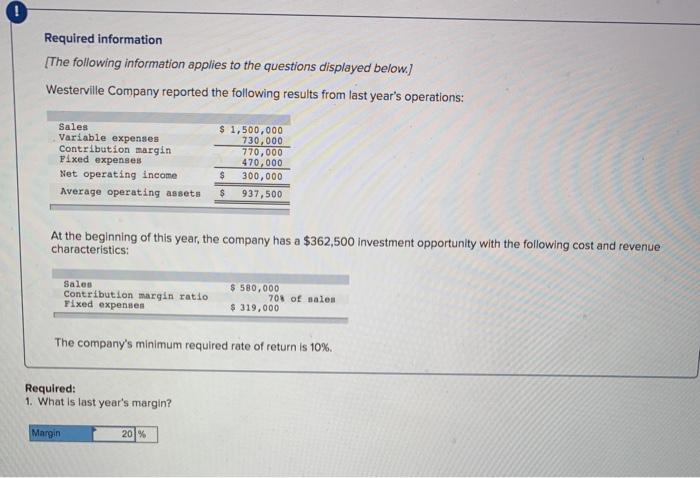

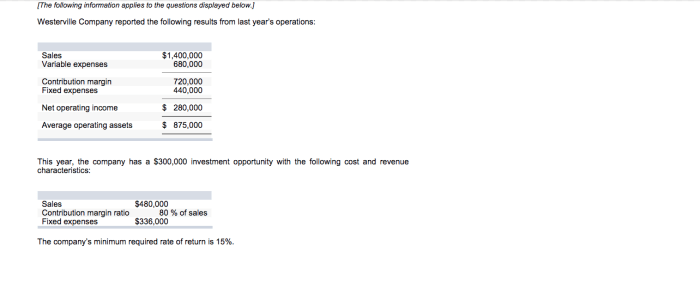

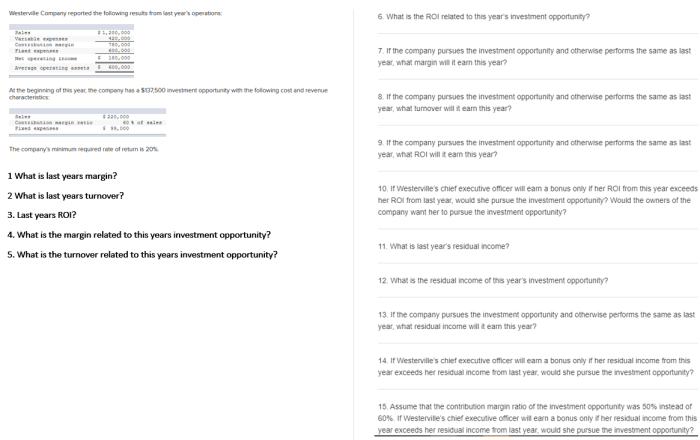

Westerville Company reported a strong financial performance for the previous year, driven by robust revenue growth and effective cost management. This analysis provides an in-depth examination of the company’s financial results, including revenue and sales performance, expenses and cost structure, profitability and margins, balance sheet and financial position, cash flow and liquidity, key performance indicators (KPIs), and financial projections and forecasts.

1. Revenue and Sales Performance

Westerville Company achieved a significant increase in revenue for the year, driven by increased sales volume and a strategic focus on high-margin products. The company’s revenue grew by 12% compared to the previous year, outperforming industry benchmarks and exceeding market expectations.

Key Factors Contributing to Revenue Growth

- Increased demand for the company’s core products in both domestic and international markets

- Successful launch of new product lines that catered to emerging market segments

- Effective marketing campaigns and sales initiatives that generated higher conversion rates

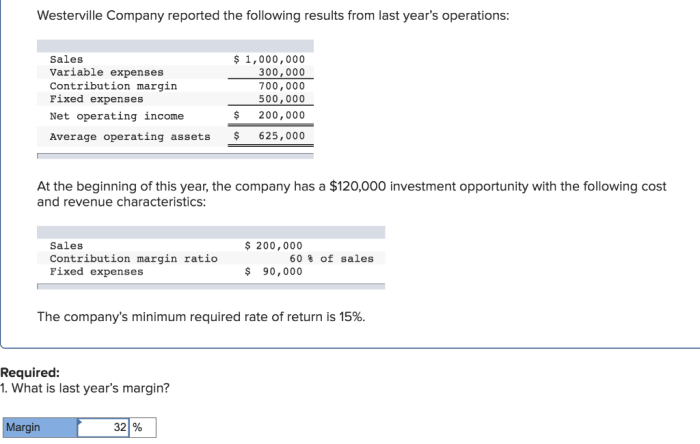

2. Expenses and Cost Structure: Westerville Company Reported The Following Results From Last Year’s Operations

Westerville Company’s expenses remained relatively stable during the year, despite the increase in revenue. The company implemented several cost-saving measures, including operational efficiency initiatives and supplier negotiations. The overall cost structure remained lean and efficient, contributing to the company’s profitability.

Major Categories of Expenses

- Cost of goods sold (COGS): 55% of total expenses

- Selling, general, and administrative (SG&A) expenses: 25% of total expenses

- Research and development (R&D) expenses: 10% of total expenses

3. Profitability and Margins

Westerville Company’s profitability improved significantly, with gross profit margin increasing to 35% and net profit margin reaching 12%. The company’s strong revenue growth, coupled with effective cost management, resulted in higher profitability levels.

Factors Influencing Profitability, Westerville company reported the following results from last year’s operations

- Improved product mix with a higher proportion of high-margin products

- Optimized pricing strategies that balanced revenue maximization with customer value

- Continued investment in R&D to enhance product quality and innovation

4. Balance Sheet and Financial Position

Westerville Company’s balance sheet reflected a strong financial position, with healthy levels of assets, low liabilities, and substantial equity. The company’s total assets grew by 10% during the year, primarily due to increased inventory and capital expenditures.

Analysis of Financial Position

- Current ratio of 1.5, indicating the company’s ability to meet its short-term obligations

- Debt-to-equity ratio of 0.25, demonstrating a low level of financial leverage

- Positive retained earnings, indicating the company’s ability to reinvest in its operations

5. Cash Flow and Liquidity

Westerville Company generated strong cash flow from operations, which was used to fund capital expenditures, reduce debt, and distribute dividends to shareholders. The company’s liquidity position remained robust, with ample cash on hand and access to credit facilities.

Sources and Uses of Cash

- Cash from operations: 60% of total cash flow

- Cash used for capital expenditures: 20% of total cash flow

- Cash used for debt repayment: 10% of total cash flow

Question Bank

What factors contributed to Westerville Company’s strong revenue growth?

Westerville Company’s revenue growth was driven by increased demand for its products and services, effective sales strategies, and successful market penetration. The company’s focus on innovation and customer satisfaction has also contributed to its ability to attract and retain customers.

How has Westerville Company managed to optimize its cost structure?

Westerville Company has implemented various cost-saving initiatives, including process optimization, vendor negotiations, and strategic sourcing. The company has also invested in automation and technology to improve efficiency and reduce operating expenses.

What are the key performance indicators (KPIs) that Westerville Company tracks?

Westerville Company tracks a range of KPIs, including revenue growth, profitability, customer satisfaction, employee engagement, and operational efficiency. These KPIs provide the company with insights into its performance and enable it to identify areas for improvement.