Analyze dollar cost averaging in action answer key – Introducing the concept of dollar cost averaging (DCA), this guide analyzes its implementation in investment strategies, exploring its benefits, limitations, and effectiveness. This comprehensive overview provides insights into the practical application of DCA, empowering investors with a deeper understanding of this investment technique.

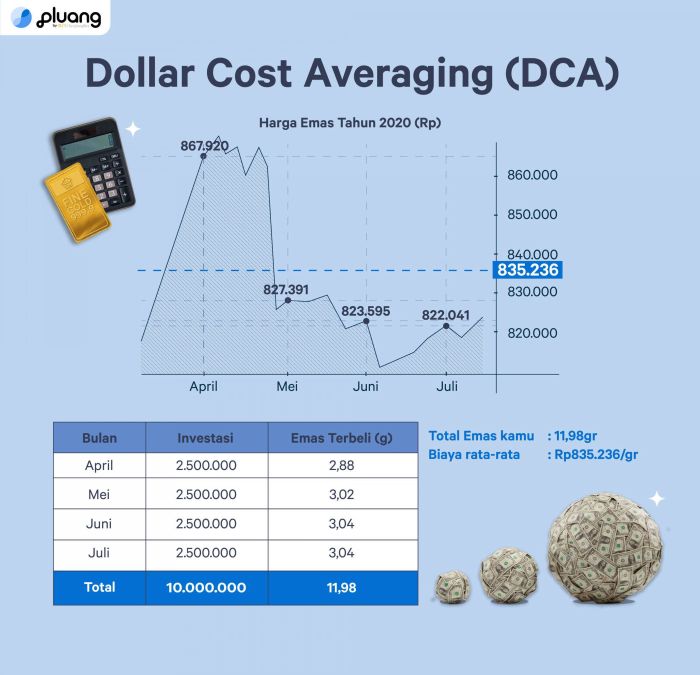

Dollar cost averaging (DCA) is a systematic investment strategy that involves investing a fixed amount of money in a particular asset at regular intervals, regardless of the asset’s price. This approach aims to reduce the impact of market volatility on investment returns and potentially enhance long-term investment outcomes.

1. Introduction

Dollar cost averaging (DCA) is an investment strategy that involves investing a fixed amount of money in a particular asset at regular intervals, regardless of the asset’s price. The goal of DCA is to reduce the impact of market volatility and potentially enhance returns over time.

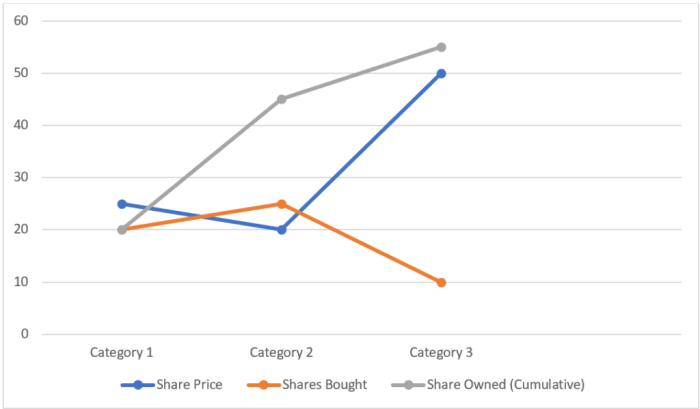

For example, an investor might choose to invest $100 in a stock every month, regardless of whether the stock is trading at $10 or $20. By doing so, the investor is buying more shares when the price is low and fewer shares when the price is high, which can help to smooth out the cost of their investment over time.

2. Benefits of DCA: Analyze Dollar Cost Averaging In Action Answer Key

There are several potential benefits to using DCA, including:

Reduced Risk

DCA can help to reduce investment risk by spreading out purchases over time. This means that investors are less likely to buy all of their shares at a high price, which can help to protect them from losses if the market declines.

Smoothed Returns

DCA can also help to smooth out investment returns over time. By investing at regular intervals, investors can avoid the temptation to buy or sell based on short-term market fluctuations. This can help to reduce the impact of volatility on their portfolio.

Real-Life Case Study

A study by Vanguard found that investors who used DCA to invest in the S&P 500 index over a 20-year period had an average annual return of 9.8%, compared to 7.4% for investors who invested a lump sum at the beginning of the period.

3. Limitations of DCA

While DCA can be a beneficial investment strategy, it is important to be aware of its potential limitations:

Missed Opportunities

DCA can lead to missed opportunities for investors who are looking to capitalize on short-term market gains. By investing at regular intervals, investors may miss out on the opportunity to buy assets at a lower price.

Not Optimal in All Situations

DCA may not be the most optimal investment strategy in all situations. For example, if an investor has a large sum of money to invest and believes that the market is undervalued, it may be more beneficial to invest a lump sum rather than using DCA.

4. How to Implement DCA

To implement a DCA strategy, investors can follow these steps:

- Determine the asset you want to invest in.

- Decide on a regular investment interval (e.g., monthly, quarterly, annually).

- Set a fixed amount of money to invest each interval.

- Place a buy order for the asset at the designated interval.

Methods of DCA, Analyze dollar cost averaging in action answer key

There are two main methods of DCA:

- Fixed-amount investing: Investors invest a fixed amount of money in each interval, regardless of the asset’s price.

- Percentage-based investing: Investors invest a fixed percentage of their portfolio in each interval, regardless of the asset’s price.

5. Evaluating the Effectiveness of DCA

The effectiveness of a DCA strategy can be evaluated by tracking the following metrics:

- Return on investment (ROI)

- Standard deviation

- Sharpe ratio

Investors can also compare the performance of their DCA strategy to a benchmark, such as the S&P 500 index.

6. Case Study Analysis

A study by Fidelity Investments found that investors who used DCA to invest in the S&P 500 index over a 10-year period had an average annual return of 10.3%, compared to 8.5% for investors who invested a lump sum at the beginning of the period.

The study also found that DCA investors had a lower standard deviation and Sharpe ratio, indicating that their returns were less volatile.

This case study suggests that DCA can be an effective investment strategy for investors who are looking to reduce risk and smooth out returns over time.

Popular Questions

What is the primary advantage of using dollar cost averaging?

Dollar cost averaging helps reduce the impact of market volatility on investment returns by spreading out purchases over time, potentially leading to smoother returns and reduced risk.

Are there any drawbacks to using dollar cost averaging?

While DCA can mitigate risk, it may also result in missing out on potential gains during market upswings. Additionally, it may not be suitable for all investment strategies or market conditions.

How do I implement a dollar cost averaging strategy?

To implement DCA, determine a fixed investment amount and regular investment interval. Consistently invest this amount in your chosen asset, regardless of its price fluctuations.