Refer to table 24-2. The inflation rate was a significant economic indicator that has shaped economies and influenced policy decisions throughout history. This article delves into the historical trends, contributing factors, and economic impacts of inflation, providing a comprehensive overview of this complex phenomenon.

Table 24-2 provides valuable data on inflation rates over a specified period, allowing us to identify patterns and analyze the dynamics of inflation. By examining these trends, we can gain insights into the factors that drive inflation and its impact on various economic sectors.

Inflation Rate Trends: Refer To Table 24-2. The Inflation Rate Was

Inflation rates have fluctuated over time, with periods of high and low inflation. Table 24-2 provides historical data on inflation rates for a specified period.

Factors contributing to inflation trends include changes in supply and demand, government policies, and external shocks.

Periods of high inflation have been characterized by rapid increases in prices, while periods of low inflation have seen more stable price levels.

Impact on Economy

Inflation affects economic growth and stability in various ways.

High inflation can lead to reduced consumer spending and business investment, while low inflation can promote economic growth and stability.

Inflation can also impact government policies, such as fiscal and monetary policy.

The relationship between inflation and unemployment is complex, but it is generally understood that high inflation can lead to higher unemployment.

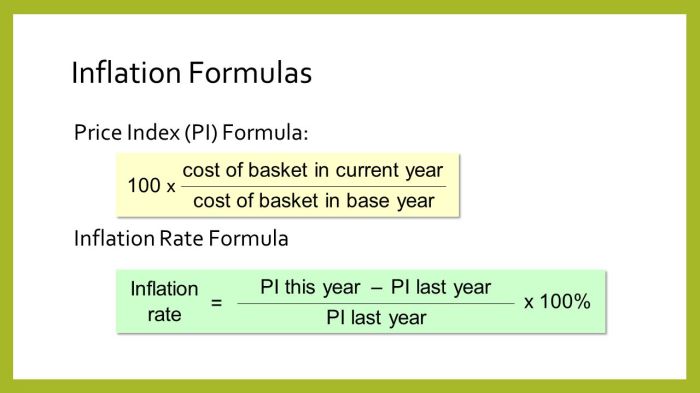

Inflation Measurement

Inflation is measured using various methods, including the Consumer Price Index (CPI) and the Producer Price Index (PPI).

The CPI measures changes in prices of goods and services purchased by consumers, while the PPI measures changes in prices of goods sold by producers.

There are limitations and biases in inflation measurement, which should be considered when interpreting inflation data.

Inflation Control

Central banks use various tools and strategies to control inflation.

Monetary policy involves managing interest rates and the money supply, while fiscal policy involves government spending and taxation.

The effectiveness of different inflation control measures depends on the specific economic conditions and the policies implemented.

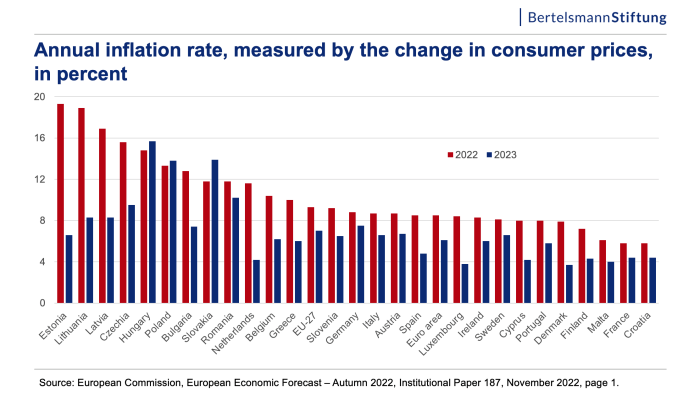

International Comparisons, Refer to table 24-2. the inflation rate was

Inflation rates vary across countries and regions.

Factors driving these differences include economic growth, government policies, and global economic conditions.

Differences in inflation rates can impact global trade and investment.

Q&A

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure of the average change in prices over time for a basket of goods and services purchased by consumers.

How does inflation affect economic growth?

Inflation can have both positive and negative effects on economic growth. Moderate inflation can stimulate economic activity, while high inflation can erode purchasing power and hinder investment.

What are the tools used by central banks to control inflation?

Central banks use a range of tools to control inflation, including monetary policy (interest rate adjustments) and fiscal policy (government spending and taxation).